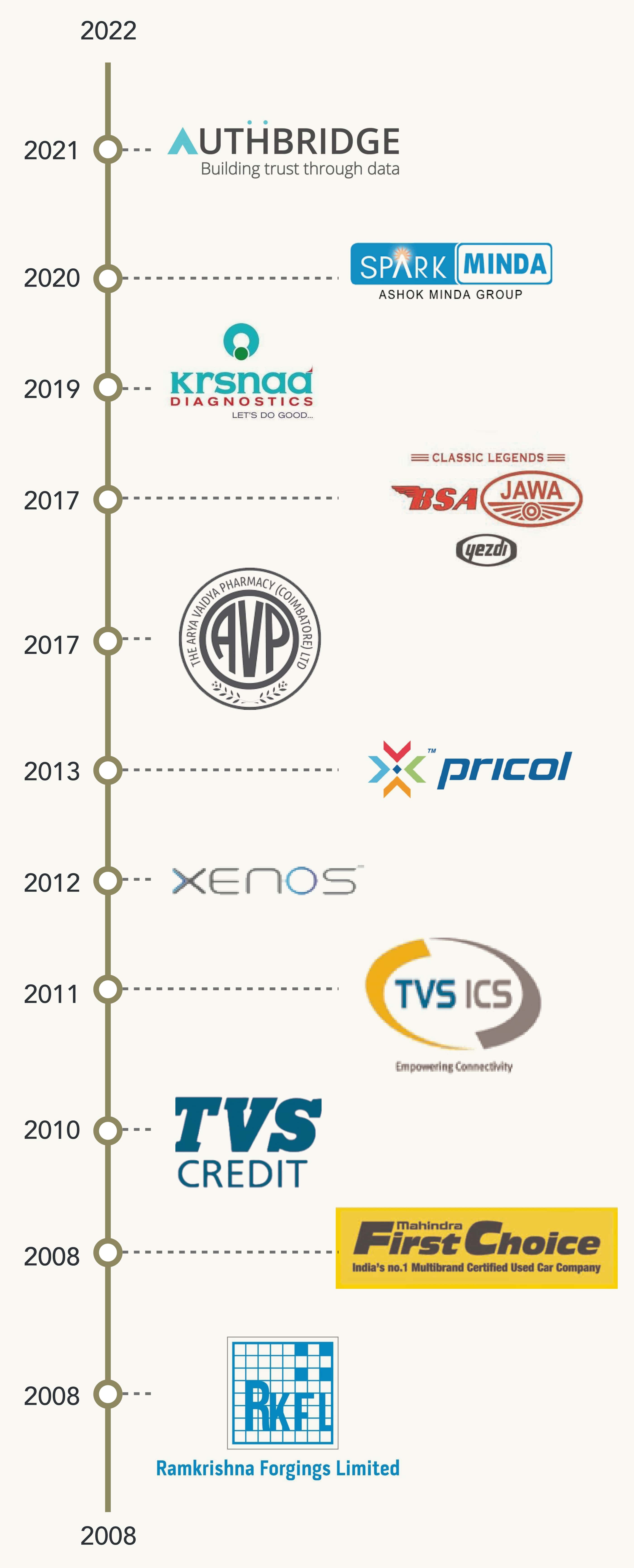

We are a team of business transformation specialists, who started our journey with the iconic Royal Enfield in 2005 and have not looked back since

We are a team of entrepreneurial business builders unique in our ability to start even from scratch and create a large-scale business (Mahindra First Choice), and then do it again (TVS Credit Services) and again ( Classic Legends- Jawa, Yezdi, BSA).

We don’t source our investments, more often than not, our investments originate from our investee companies, to partner with them to transform their business for the next generation or simply scale. We NEVER participate in a process.

Quite often, our promoter partners, do not need only our capital and Phi’s investment is taken just so that we can get compensated for the value we create.

Most investments originate from partners

relationships, networks & initiatives and

Inbound requests

Phi has also incubated businesses in unique

structures where we can create value at scale,

a testament to our buyout strategy.

Phi does not participate in formal fund raise

processes however Phi seeks to identify

targets in sectors where it believes that the

thesis is compelling for value creation given

Phi’s unique expertise.

Phi has industry stalwarts / turnaround experts

as operating partners who have helped us

create a track record of Operational

Excellence

Governance & say in the capital structure and

P&Ls are non-negotiables for Phi.

Mostly, investment decisions are an outcome of months of pro bono work with the investee companies, partners relationships, networks

& initiatives.

The pro-bono phase also helps us to have a ring side view of the asset, conduct an extended due diligence

and ascertain alignment of the management to partner with Phi for their business.

}

}